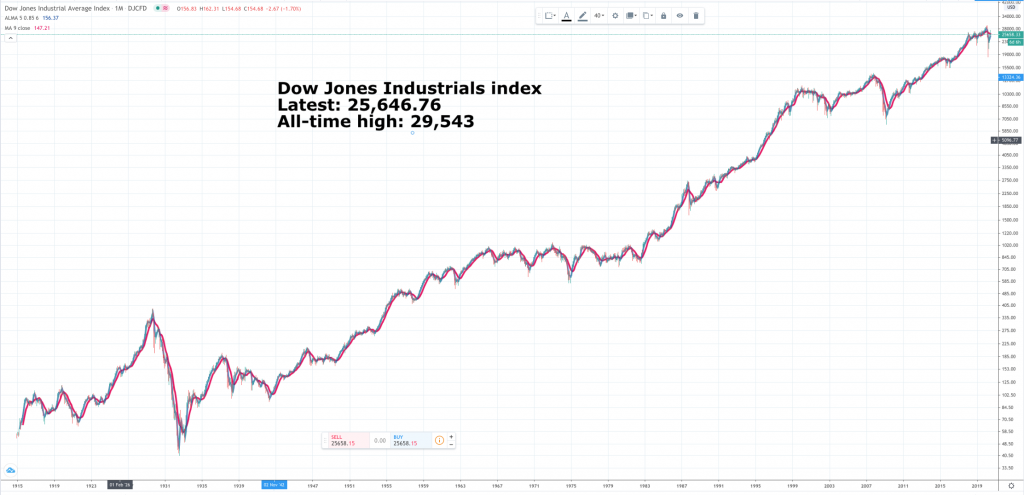

This chart offers a historical view of the Dow Jones Industrials. Since December 1914, roughly the start of the first world war, the index, which includes 30 of the largest US companies by market value, has risen from 55 to 25,665, a rise of almost 467 times in 106 years; that equates to 5.97pc a year, which was less than I expected but still a respectable figure given that it includes two world wars, a global depression and numerous recessions.

In the summer of 1982, which is when the battle against inflation began in earnest across the developed world, the index was around 770. Since then it has climbed 33-fold in 38 years, which translates to annual compound growth of 9.66pc.

Another thing which happened in 1982 was that the technology revolution began to take off. There had been computers before, back in the day IBM had been a name to conjure with for investors but Microsoft, a major driver of the desktop revolution, which laid the beginnings of the connected world, was floated in 1986.

Globalisation also began to happen, with the collapse of the USSR in the 1980s and the rule of Deng Xiao Ping in China unleashing capitalism with Chinese characteristics.

Last but not least, Margaret Thatcher, in the UK, effectively privatised the British economy ushering in a sustained period of strong growth, while supply side economics under President Reagan did something similar in the USA.

The result has been decades of strong growth, falling unemployment, low interest rates and low inflation. It has been a spectacular period and this has been reflected in stronger stock markets.

Last but not least has been two dramatic bear markets in the first decade of the 21st century against the backdrop of a period of accelerating technological change. The shift from an offline to an increasingly online world has most recently been turbocharged by the stay-home economy that has emerged out of Covid-19 and the associated economic lockdowns.

This too is reflected in the chart. Since March 2009 the index has climbed roughly fourfold in 11 years, which equates to compound annual growth of 13.3pc. More technology weighted indices like the Nasdaq Composite and the Nasdaq 100 have compounded annually since 2009 at 20.7pc and 23.34pc. The Nasdaq 100 Technology index, which is even more focused on technology, has compounded by 24.72pc since 2009.

The bottom line of all this is that in very broad terms, share prices which had been compounding at around six per cent for much of the 20th century and actually less earlier since the rate speeded up after 1982 are now compounding at between 13.5pc and 25pc depending on which index you use. It is an exciting picture of accelerating growth in share prices supported by a growing swathe of very fast growing quoted businesses.

This is all about America. In Europe and the UK, indices have made minimal progress in the 21st century, which seems to be leaving the old world behind. It is as though Europe is reconciled to becoming a tourist attraction for visitors from the New World and The Far East. No problem, I suppose, if that is what people want but the smart money will be invested on Wall Street, not here, where they will find a growing selection of growth stocks from all over the the world though still the lion’s share will be home grown.

As I was writing the indices were taking a hit, with the Dow Jones down nearly 700 points and the Nasdaq 100 down 200 points or around two per cent. I am using this as an opportunity to make a string of buying recommendations. I believe this Made in America bull market has a long way still to run, albeit there is likely to be considerable volatility given the activities of day traders and momentum traders with short horizons.

Investors, who want to participate, will have to grow used to buying shares on very high valuations and that is another factor that makes for volatility. Traditional valuation benchmarks don’t work for businesses with 90pc gross profit margins, which are investing so heavily in growth that they continue to make losses, while growing sales at 30, 40. 50 or even 100pc annually. The truth is that it is very hard to value such businesses leaving scope for investors to veer between euphoria and panic. Investor, who can stand the gyrations should be rewarded with strong growth over the longer haul.

Periodically, I go through my various recommendation tables and below are some of the results. There are many exciting stocks that are in the QV portfolio but not in the list below, which is somewhat arbitrary. As you can see I still believe it is a good time to be an aggressive investor. The virus has created a favourable backdrop for technology shares, of which there is a growing selection to choose although many of these shares will be unfamiliar names, especially to new subscribers; that’s the brave new world in which we live. I am discovering new, exciting, technology focused companies, almost every day and there is a strong pipeline of IPOs for the second half of 2020.

A key rule in all my publications is that if I mention a share, unless I specifically say different, I am suggesting that you buy it. I keep careful records of my recommendations, which is how I know how well I am doing. I also know that many of my subscribers read what I say and then do something different, which is fair enough. We all have to find our investing style.

I never look for value, never look for cheap stocks and only buy low, when the whole market takes a dive, say because of a virus. It is very rare for me to buy low with individual shares and if they are falling because of problems specific to the company I won’t go near them and if I had them would immediately sell them. This helps protect me from disasters like Wirecard, which was last recommended in QV on 6 June 2018.

Since then I had this to say about them on 6 May 2020. ‘In division four are the basket cases. They could recover but they are really struggling now. The list includes Accesso, Asos, Burford Capital, Canada Goose, Corporate Travel Management, Craneware, Genscript Biotech, Get Swift, Inogen, IQE, James Cropper, NMC Health, Superdry, Victoria, Weight Watchers, Wirecard AG, Wisetech Global and Yu Group. If your approach to investing is anything like mine and you ever held these stocks you sold them long ago. If you still hold any of them you are being far too patient with the duds. When a stock goes wrong you need to get out, move on, redeploy the funds in a business that is doing well, not badly. It really is that obvious. ALL THE SHARES IN YOUR PORTFOLIO SHOULD BE IN COMPANIES THAT ARE DOING WELL! The key is to dump the duds and not be preoccupied with taking a loss; taking losses is part and parcel of being an efficient investor. I sell shares at a loss all the time, don’t give it a thought.’

At the time Wirecard shares were €87. They are currently €1.84 and the CEO has been arrested!

QV is all about backing success, chasing momentum, looking for those companies, which are 3G with Magic in the expectation that as the years pass the company will grow and the shares will rise in value. It is a powerful technique. I have been doing it all my life and have found many phenomenal winners. I have never been interested in cheap stocks. I leave them to Benjamin Graham and his famous search for cigarette butts with one last puff in them. I want stocks that are the equity equivalent of superheroes and that is all I look for, growth, growth and growth, the faster the better but only if it is being delivered in a sustainable way – true growth, not the illusion of growth from a cyclical bounce.

All the stocks listed below, most of which are already in the QV portfolio, are either true growth stocks or sometimes more speculative but with a real basis for investors to be excited. In the context of a high-powered portfolio delivering impressive results we can include one or two moon shots like the biopharmas. Usually I am not very keen on such lottery ticket stocks but something seems to be stirring in the world of healthcare and I don’t want to miss out if a major boom is getting underway. They are raising huge amounts of money so knowledgeable investors are clearly showing interest. My hunch is that we are moving from the era of old style treatments like chemotherapy to a new world of immunotherapy and other stuff I know even less about – hopefully bringing good news for patients and investors.

Shares in bold are newcomers to the QV for Shares portfolio.

ADC Therapeutics/ ADCT Buy @ $41.35 Biopharma developing new drugs – “deep clinical and research pipeline of therapies for the treatment of hematological and solid tumor cancers with significant unmet need” – Next figures due: 2 September

Adobe Systems/ ADBE Buy @ $430 Multimedia and creativity software – “Adobe is the digital experiences company, with millions of global customers relying on our products every day to create the world’s content, automate critical document processes and engage with their customers digitally.” – Next figures due: 15 September

Afterpay/ APT Buy @ A$57 Buy now pay later software platform – “Clearpay, part of global instalments payments innovator Afterpay Limited Group announced that there are now more than one million active shoppers in the U.K. using the service making Clearpay one of the fastest growing e-commerce payment companies in the European market.” Next figures due: 19 August

Alibaba/ BABA Buy @ $224.50 Chinese e-commerce and cloud computing giant – “Despite the impact of COVID-19 pandemic, Alibaba achieved a historical milestone of US$1 trillion in GMV [gross merchandise volume] across our digital economy this fiscal year.” Next figures due: 13 August

Amazon/ AMZN Buy @ $2737 E-commerce. streaming, cloud services. – “From online shopping to AWS to Prime Video and Fire TV, the current crisis is demonstrating the adaptability and durability of Amazon’s business as never before, but it’s also the hardest time we’ve ever faced.” Next figures due: 23 July

Apple/ AAPL Buy @ $361 The company designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. – “Given the lack of visibility and uncertainly in the near term, we will not be issuing guidance for the coming quarter. Over the long term though, we have a high degree of confidence in the enduring strength of our business.” Next figures due: 28 July

Atlassian/ TEAM Buy @ $176 With our 170,000+ customers and team of 4,000+ Atlassians, we are building the next generation of team collaboration and productivity software. – “We will leverage our resilient culture and the strength of our business model to take share in the massive markets that we serve.” Next figures due: 27 July

Autodesk/ ADSK Buy @ $323 Autodesk makes software for people who make things. If you’ve ever driven a high-performance car, admired a towering skyscraper, used a smartphone, or watched a great film, chances are you’ve experienced what millions of Autodesk customers are doing with our software. – “In China, usage dropped rapidly in February but rebounded above pre-COVID levels by end of March as businesses started reopening in the region. And it’s no surprise we saw a major surge in usage of our cloud collaboration products as people worked from home and throughout the quarter.” Next figures due: 20 August

Avalara/ AVLR Buy @ $129 Avalara is a leading provider of cloud-based tax compliance solutions. Avalara delivers solutions for global transaction taxes, including sales and use, VAT, GST, excise, communications, lodging, and other indirect tax types, that are designed to help businesses achieve and maintain compliance. Our vision is to be the global cloud compliance platform. – “We believe this crisis will accelerate businesses move to the cloud and e-commerce and we will be there alongside our partners to help businesses succeed in their journey.” Next figures due: 6 August

Axon Enterprise/ AAXN Buy @ $93 Axon is a market-leading provider of law-enforcement technology. – “All that said, I couldn’t be more bullish on Axon. We are change agents. Our adaptability and innovation centric approaches are unique advantages for us when the world changes rapidly as this is happening right now.” Next figures due: 11 August

Bandwidth/ BAND Buy @ $124 Bandwidth is a software company focused on communications for the enterprise. Companies like Google, Microsoft, Cisco, Zoom and Ring Central use Bandwidth’s APIs to easily embed voice, messaging and 911 access into software and applications. Bandwidth is the first and only CPaaS provider offering a robust selection of communications APIs built around their own nationwide IP voice network – one of the largest in the nation. – “Our robust platform and nationwide network scaled in days to meet the 30pc surge in concurrent call demand caused by so many Americans working from home.” Next figures due: 29 July.

Beigene/ BGNE Buy @ $186 BeiGene is a global, commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercialising innovative medicines to improve treatment outcomes and access for patients worldwide. Our 3,800+ employees in China, the United States, Australia, and Europe are committed to expediting the development of a diverse pipeline of novel therapeutics for cancer. – “We have been pleased with the progress of the lifirafenib and mirdametinib combination therapy trial to date, and we look forward to commencing dose expansion cohorts in the coming months. There remains a significant unmet need for the nearly one-third of solid tumor patients whose cancers are driven by RAS mutations, RAF mutations, and other MAPK pathway aberrations, and this combination therapy represents a novel targeted approach for these tumours.” Next figures due: 5 August

Bill.com/ BILL Buy @ $80 We are a leading provider of cloud-based software that simplifies, digitises, and automates complex back-office financial operations for SMBs. By transforming how SMBs manage their cash inflows and outflows, we create efficiencies and free our customers to run their businesses. – “Now let me turn to our third-quarter financial performance. Core revenue, which we define as subscription plus transaction revenue, grew by 63pc year-over-year to $36.1m. Total revenue in the quarter grew by 46pc year-over-year to $41.2m. We also delivered strong non-GAAP gross margins of 78.8pc in the quarter. At the end of the quarter, we had over 91,000 customers, representing 28pc year-over-year growth.” Next figures due: 2 September

BioTechne Labs/ Buy @ $252 At Bio-Techne, we have united multiple brands to provide a unique and comprehensive product portfolio. Together, our brands provide world class products and services for life-science research and clinical applications. – “While COVID-19 negatively impacted our business this quarter, primarily due to the temporary shutdown of academic labs, we are playing a critical role in the global fight to develop tests and cures for the virus. Overall, we were having a very strong Q3 until the virus pandemic had a pronounced impact on our business in mid-March. But even so, we ended the quarter with 6pc organic growth.” Next figures due: 11 August

BioXcel Therapeutics/ BTAI Buy @ $58 BioXcel Therapeutics, Inc. is a clinical-stage biopharmaceutical company that utilises novel artificial intelligence, or AI, to identify the next wave of medicines across neuroscience and immuno-oncology. – “We are on track to report top-line data from the SERENITY program in mid-2020 and will communicate updates as we get closer to our clinical data readout. It is important to note that all schizophrenia and bipolar patients enrolled have successfully self-administered the BXCL501 treatment guided by a healthcare provider. With our pivotal program readouts only a few months away, we are hopeful that we will be able to submit our first NDA for BXCL501 during the first half of 2021, bringing a noninvasive fast-acting treatment within millions of patients who suffer from acute agitation associated with neuropsychiatric disorders. Our clinical progress continued with the initiation of TRANQUILITY.” Next figures due: 5 August

Blackline/ BL Buy @ $80 BlackLine is transforming and modernising the way finance and accounting departments operate. Our cloud-based software platform supports critical finance and accounting processes, including the financial close, account reconciliation, inter company accounting and controls assurance. – “I can’t imagine what month end must be like for companies that don’t have BlackLine. Over the last two years, we have heavily invested in global resources around account management, and we believe we can capture expansion within our existing accounts.” Next figures due: 30 July

Boohoo Group/ BOO Buy @ 405p Boohoo is home to a portfolio of innovative fashion brands targeting style and quality conscious consumers with up-to-date and inspirational fashion. What started as one brand, growing extensively in the UK and Internationally, is today a platform of multiple brands servicing customers globally, generating sales in excess of £1bn. – “Revenues in our first quarter totalled £367.8m, up 45pc year on year, with strong underlying growth across boohoo, PLT and Nasty Gal. Our newest brands (MissPap, Karen Millen and Coast) continue to trade strongly having successfully integrated onto the group’s scalable platform last year. Performance across all of our brands and geographies improved throughout April, with a robust performance delivered in May.” Next figures due: 23 September

Cable One/ CABO Buy @ $1747 Cable One, Inc. is a leading broadband communications provider serving more than 900,000 residential and business customers in 21 states through its Sparklight™ and Clearwave brands. Sparklight provides consumers with a wide array of connectivity and entertainment services, including high-speed internet and advanced Wi-Fi solutions, cable television and phone service. Sparklight Business and Clearwave provide scalable and cost-effective products for businesses ranging in size from small to mid-market, in addition to enterprise, wholesale and carrier customers. – “In the second quarter we’ve already added more residential agency customers in the first month that we did throughout the entire first quarter.’” Next figures due: 11 August

Cadence Design Systems/ CDNS Buy @ $92 Cadence is a pivotal leader in electronic design, building upon more than 30 years of computational software expertise. – “There has been a silicon renaissance in the industry with strong design activity being driven by generational technology drivers such as 5G, AI, hyperscale computing and industrial IoT. So far, even in the current environment, we do not see any slowdown in design activity. And I do believe this period to be an opportunity especially for market shaping customers to further invest in R&D and accelerate their innovation.” Next figures due: 22 July

Carvana/ CVNA Buy @ $113 Carvana operates as an online-only used car dealer that allows customers to shop, finance, and sell or trade-in cars through their website. – “We began to see significant reductions in demand in the back half of March with a sales trough in early April at approximately 30pc reduction in sales year-over-year. From there, we have consistently improved week after week, with sales in the most recent weeks being up about 20pc to 30pc year-over-year. Viewed through medium-term lens, we believe customer behaviour shifts are likely to accelerate our progress.” Next figures due: 5 August

Chioptle Mexican Grill/ CMG Buy @ $1048 An American chain of fast casual restaurants in the United States, United Kingdom, Canada, Germany, and France, specialising in tacos and Mission-style burritos. – “Our rewards program is only a year old as of March. And it’s already got 12m, 13m people in it. Thanks to owning all the restaurants and having a balance sheet where we had no real liquidity concerns we were able to say, okay, we can weather the storm, keep investing in our people, keep investing in digital, and get to the other side of this thing with a much more powerful digital business. And we know we can reclaim the business that Chipotle was doing.” Next figures due: 22 July

Cloudflare/ NET Buy @ $35 We have built a global cloud platform that delivers a broad range of network services to businesses of all sizes around the world—making them more secure, enhancing the performance of their business-critical applications, and eliminating the cost and complexity of managing and integrating individual network hardware. Today, approximately 13pc of the Fortune 1,000 are paying Cloudflare customers. – “We had a very strong quarter. Our Q1 revenue finished at $91m, up 48pc year on year.” Next figures due: 2 September

Coupa Software/ COUP Buy @ $257 Coupa Software is a leading provider of BSM [business service management] solutions. We offer a comprehensive, cloud-based BSM platform that has connected hundreds of organisations with more than five million suppliers globally. – “Our strong balance sheet and disciplined financial model allow us to invest in the business with resiliency and long-term growth in mind. In Q1, given the richness of talent in the market, we hired new employees at a pace that was relatively in line with recent quarters. Despite the unsettling environment we all experience, we had Coupa deliver strong results in Q1, including record revenue of $119m.” Next figures due: 8 September

Crowdstrike/ CRWD Buy @ $103 CrowdStrike was founded in 2011 to reinvent security for the cloud era. With our Falcon platform, we created the first multi-tenant, cloud native, intelligent security solution capable of protecting workloads across on-premise, virtualised, and cloud-based environments running on a variety of endpoints such as laptops, desktops, servers, virtual machines, and Internet of Things, or IoT, devices. – “With strength in multiple areas of the business, we added $86m in net new ARR in the first quarter, which was ahead of our expectations.” Next figures due: 4 September

Datadog/ DDOG Buy @ $88.50 The monitoring and analytics platform for developers, IT operations teams, and business users in the cloud age. – “While there is a lot more certainty across the industry and the broader economy in the very near term, we believe it is more important than ever for businesses to operate online, and that the trends of digital transformation and cloud migration remain very much intact over the long-term and may even be accelerated or amplified. We believe we are well positioned to be a primary beneficiary of this trend and continue to win in the market.” Next figures due: 12 August

Dexcom/ DXCM Buy @ $394.3 Empowers people to take control of diabetes through innovative continuous glucose monitoring (CGM) systems. Dexcom has emerged as a leader of diabetes care technology. – “First-quarter revenue grew to $405m, representing 44pc growth over the first quarter of 2019 or greater than $120m of absolute dollar growth. This performance was driven by strength in new patient additions in both the U.S. and international businesses, even as we saw some impact to new patient opportunities related to COVID-19 beginning in mid-March.” Next figures due: 4 August

Docusign/ DOCU Buy @ $163 We pioneered eSignature and now we’ve created the world’s first agreement cloud. – “Our billings grew 59pc year-over-year to $342m, and revenue grew 39pc to $297m. This strong growth was driven by used case expansion across a broad cross section of our installed base, as well as adoption by new customers. We added more than 10,000 net new direct customers and almost 58,000 self service customers, bringing our global total of paying customers to nearly 661,000. We believe this surge in eSignature adoption bodes well for future Agreement Cloud expansion.” Next figures due; 4 September

Epam Systems/ EPAM Buy @ $247.5 Since 1993, EPAM has leveraged its software engineering expertise to become a leading global product development, digital platform engineering, and top digital and product design agency. – “I’m pleased to share that we delivered a stronger-than-expected first quarter results with revenue of $651m representing 26pc% in constant currency growth. Despite some of the early COVID-19 reactions in APAC and the first global pandemic impacts in March Q1 came in $9m higher than our initial guidance underscoring the value of our diverse and high-quality portfolio and our ability to continue providing relevant and mission-critical services to our clients. Q1 marked also EPAM’s 37th consecutive quarter of 20-plus percent organic growth – the rate of growth we plan to return to post crisis.” Next figures due: 30 July

Etsy/ ETSY Buy @ $98 The global marketplace for unique and creative goods. We connect millions of buyers and sellers from nearly every country around the world to leverage the power of business.” – “We delivered $1.4bn in consolidated gross merchandise sales in the first quarter, 32pc year-over-year growth. Etsy’s stand-alone delivered 16pc year-over-year growth in GMS. Revenue was about $228m, and adjusted EBITDA was about $55m. April was an extraordinary month. And I mean it in the sense of extraordinary very, very big and extraordinary very unusual. First was the effect of the sale of fabric face masks, and Etsy sold about $133m worth of fabric face masks in the month of April. Separate and in addition to that, the core Etsy marketplace grew very, very robustly in April, 79pc year-over-year growth.”: Next figures due: 30 July

Facebook/ FB Buy @ $234 Social media giant – “We’re seeing major increases in use of our services. For the first time ever, there are now more than 3bn people actively using Facebook, Instagram, WhatsApp, or Messenger each month. That includes 2.6bn people using Facebook alone and more than 2.3bn people using at least one of our services every day. In many of the places that have been hardest hit by the virus, messaging volume has increased more than 50pc, and voice and video calling has more than doubled across Messenger and WhatsApp.” Next figures due: 22 July

Fastly/ FSLY Buy @ $76 With Fastly’s edge cloud platform, our customers are disrupting existing industries and creating new ones. Today, our platform handles hundreds of billions of internet requests a day. – “We delivered strong first quarter results with continued top line growth generating $63m in revenue, up 38pc year-over-year. We continue to see strong customer adoption of our edge cloud platform and security products by both new and existing customers across multiple verticals. ” Next figures due: 6 August

GSX Techedu/ GSX Buy @ $56 A technology-driven education company and a leading online K-12 large-class after-school tutoring service provider in China. – “Despite the severe challenges brought by the COVID-19, we have achieved a remarkable result in the first quarter. Net revenue increased by 382pc year over year to RMB 1.298bn. This is our sixth consecutive quarter with revenue growth more than 350pc. Our K-12 revenue growth rose 448pc year over year. In fact, our K-12 revenue growth has exceeded 400pc each quarter since we went public.” Next figures due: 20 August Note: US1 = 7.07 remimbi so sales of RMB 1.298bn = $183m. Subscribers should also note that GSX is engaged in a battle with short sellers, who claim the company has inflated its figures. The figures themselves are staggering, especially if they are accurate.

HelloFresh/ HFG Buy @ €44.50 The leading global provider of fresh food at home – “We have seen active customers reach about 4.2m in the first quarter, up from about 3m in the fourth quarter, and up from about 2.5m in the first quarter of 2019, so very high increase in the number of active customers. Revenue has been up by 64.5pc compared to the same period last year on a constant currency basis.” Next figures due: 13 August

Horizon Therapeutics/ HZNP7 Buy @ $55.50 A biopharmaceutical company focused on researching, developing and commercialising medicines that address critical needs for people impacted by rare and rheumatic diseases. – “Completed three transactions in the last month alone including the addition of HZN-825, a new pipeline candidate for rare rheumatic disease and two transactions to acquire payment rights related to future TEPEZZA royalties and milestones. TEPEZZA [thyroid eye disease treatment] had a fantastic launch quarter significantly outperforming our expectations. As a result, we are increasing our TEPEZZA net sales guidance for the full year to greater than $200m. We’re also raising our full year net sales guidance to range between $1.4bn and $1.45bn.’ Next figures due: 10 August

Hubspot/ HUBS Buy @ $220 Over 78,700 customers in more than 120 countries use HubSpot’s software, services, and support to transform the way they attract, engage, and delight customers. – “The pandemic for HubSpot is like a big storm that blew into our business in the middle of March but over the last few weeks of April, the winds have shifted. I’d say we have 150-mile an hour headwind now, but that’s coupled with 100-mile an hour tailwind as business has been picking up. The world is seeing a surge of companies with historically offline, old school go-to-market models leaning into a new school online go-to-market models for the first time. The very platform we sell and methodology we teach was designed to help companies make this shift. These trends represent a long-term tailwind for HubSpot, and I think it’s one that will outlast the near-term volatility that we’re all experiencing in the current downturn.” Next figures due: 29 July

IDEXX Laboratories/ IDXX Buy @ $320 Products and services for the companion animal veterinary, livestock and poultry, water testing, and dairy markets. – “Through early March, Global CAG Diagnostics recurring revenue gains were trending very strongly, above the high end of our full year goals for 11pc to 12pc organic growth. We were also tracking toward an excellent instrument placement quarter, driven by continued momentum in new and competitive catalyst placements globally. As social-distancing policies advanced more broadly in Europe and the U.S. through March and as vet clinics adapted to prioritise healthcare procedures to align with industry and government guidelines, we saw significant declines in clinical visit activity and restriction on access to vet clinics, which moderated our Q1 revenue gains.” Next figures due: 30 July

Livongo Health/ LVGO Buy @ $69.50 A platform that empowers people with chronic conditions to live better and healthier lives, beginning with diabetes and now including hypertension, weight management, diabetes prevention, and behavioural health.Our team of data scientists aggregate and interpret substantial amounts of health data and information to create actionable, personalised and timely health signals. – “We believe remote monitoring is rapidly becoming the new standard in health and care. With more than 147m Americans living with a chronic condition and 40pc living with more than one, Livongo has a significant opportunity to continue growing our member base. In the first quarter, we added a record 380 new clients, which takes us to 1,252 overall clients, which is up approximately 44pc quarter over quarter.” Next figures due: 3 September

L’Oreal/ OR Buy @ €281 It is the world’s largest cosmetics company and has developed activities concentrating on hair colour, skin care, sun protection, make-up, perfume and hair care. – “We see in China that business is bouncing back to very strong growth in these latest 10 weeks.” Next figures due: 30 July

MarketAxess/ MKTX Buy @ $510 We’ve created the largest institutional marketplace to trade bonds—promoting price transparency, more competition, and greater choice. – “The sharp increase in credit market volatility beginning in late February led to record quarterly credit trading volume on MarketAxess of $660bn up 29pc versus Q1 2019. The acceleration of trading activity led to record financial results as well. Revenues of $169m were up 36pc, operating income jumped 44pc and EPS was $1.96 up 41pc.” Next figures due: 22 July

Match Group/ MTCH Buy @ $99.50 Hundreds of millions of singles have used our brands’ dating products to create meaningful connections. Match pioneered the concept of online dating over 20 years ago, then reinvented the category by launching Tinder. – “While the short term may be choppy, longer term we’re very confident in our ability to drive solid growth for our shareholders.” Next figures due: 5 August

Microsoft/ MSFT Buy @ $198 Best known software products are the Microsoft Windows line of operating systems, the Microsoft Office suite and the Internet Explorer and Edge web browsers. Its flagship hardware products are the Xbox Edge Gaming Consoles and the Microsoft Surface lineup of touchscreen personal computers. One of the Big Five technology companies alongside Amazon, Apple, Google and Facebook. – “There is both immediate surge demand and systemic structural changes across all of our solution areas that will define the way we live and work going forward. Our diverse portfolio, durable business models, and differentiated technology stack across the cloud and the edge position us well for what’s ahead.” Next figures due: 16 July

MongoDB/ MDB Buy @ $222 The leading modern, general purpose data platform, designed to unleash the power of software and data for developers and the applications they build. – “Q1 generated revenue of $130.3m, a 46pc year-over-year increase and above the high end of our guidance. We grew subscription revenue 49pc year-over-year. Atlas revenue grew over 75pc year-over-year and now represent 42pc of our revenue. The current environment is accelerating the secular trends of which we are a long-term beneficiary. “ Next figures due: 3 September

Monolithic Power Systems/ MPWR Buy @ $225 A high performance analog semiconductor company based in the United States able to deliver highly integrated monolithic products that offer energy efficient, cost-effective solutions. – “MPS posted record first quarter revenue of $165.8m, 17.3pc higher than the comparable quarter in 2019. First quarter 2020 communications revenue of $27.9m rose $5.7m or 25.6pc from the first quarter of 2019. The year-over-year revenue increase primarily reflected higher 5G networking sales. Communications revenue represented 16.8pc of MPS’ first quarter 2020 revenue compared with 15.7pc in the first quarter of 2019. “ Next figures due: 22 July

Naspers/ NPN Buy @ ZAR3114.85 Principal operations are in internet communication, entertainment, gaming and e-commerce. – ” In September 2019 we successfully listed Prosus [thereby spinning off its holding in Tencent] on the Euronext Amsterdam. This is a significant step forward for the group and it provides easy access for a larger and deeper pool of international tech investors in our attractive portfolio. It also begins the process that will allow us to unlock substantial value in both Naspers and Prosus over time.” Next figures due: 19 November

Netflix/ NFLX Buy @ $463 The world’s leading streaming entertainment service with 183m paid memberships in over 190 countries enjoying TV series, documentaries and feature films across a wide variety of genres and languages. – “Our membership growth has temporarily accelerated due to home confinement. Q2 numbers could end up well below or well above 7.5m net new adds. depending how lockdowns develop.” Next figures due: 16 July

Paycom Software/ PAYC Buy @ $317 Our HR and payroll software works better because everything works together, with no data re-entry required. – “Q1 results were strong driven by our high margin recurring revenue business model and continued strength of new business adds. Q1 revenue of $242.4m came in above the high end of our guidance range in spite of the effects of unexpected interest rate cuts and an unemployment spike in March. The pandemic is exposing seams created by the disparate systems and that is creating a higher demand for the Paycom single database solution.” 22 July

Paylocity/ PCTY Buy @ $142 Paylocity is a leading provider of payroll and human capital management (HCM) software solutions. – “COVID-19 had a minimal impact on our financial results, which were highlighted by accelerating recurring and other revenue growth of 25.3pc. Our sales team continued to perform at a high level, with sales through March, up nearly 40pc over the same period last year. Additionally, April bookings were nearly double April 2019 and our sales team continues to win deals even now as we are coming through state shutdowns.” Next figures due: 6 August

Paypal/ PYPL Buy @ $171 PayPal is a leading technology platform and digital payments company that enables digital and mobile payments on behalf of consumers and merchants worldwide. – “In the past month, there has been unprecedented demand for our products and services. Our transactions are up 20pc year-over-year, with branded transactions up over 43pc more than double pre-COVID levels in January and February. On 1 May, we had our largest single day of transactions in our history, larger than last year’s transactions on Black Friday or Cyber Monday. Our net new actives hit record highs in April, surging over a 140pc from January and February levels, averaging approximately 250,000 net new active accounts per day. For the month of April, we added an all-time record of 7.4m net new customers.” Next figures due: 22 July

Peloton Interactive/ PTON Buy @ $57 Peloton is the largest interactive fitness platform in the world, with a loyal community of more than 2.6 million members. – “We ended the quarter with over 886,000 Connected Fitness Subscribers, representing 94pc year-over-year growth. Member count is now over 2.6m inclusive of 176,000 Peloton Digital subscribers. Our Connected Fitness Subscribers logged 44.2m workouts with us in the quarter up from 18.0m workouts in the same period last year, representing 145pc year-over-year growth.” Next figures due: 27 August

Pinduoduo/ PDD Buy @ $85.50 We are an innovative and fast growing “new e-commerce” platform that provides buyers with value-for-money merchandise and fun and interactive shopping experiences. – “COVID-19 has unleashed powerful forces that are changing the way we live, work and play. It has compressed years of behavioural change and accelerated the adoption of online commerce at an unprecedented pace. Now, more than ever, people are relying on online platforms to meet not just their discretionary but their critical needs.” Next figures due: 27 August

Pliant Therapeutics/ PLRX Buy @ $30.5 A clinical stage biopharmaceutical company focused on discovering and developing novel therapeutics that seek to halt progression of fibrotic diseases — ultimately preserving organ function. – “Idiopathic pulmonary fibrosis (IPF) is a chronic, progressive, lung disease of unknown cause affecting approximately 140,000 patients in the United States, and an estimated 30,000 to 40,000 new cases are diagnosed each year. In IPF, healthy lung tissue becomes replaced by scar tissue. As lung fibrosis progresses, it becomes more difficult for the lungs to transfer oxygen into the bloodstream. Currently, there are no therapies that effectively stop the disease progression. Pliant’s lead program, PLN-74809, targets the fibrosis process in IPF, potentially halting the disease progression. “ Next figures due: n/a

Polar Capital Technology/ PCT Buy @ 2030p Invests in a diversified portfolio of technology companies from around the world. – “The technology sector rallied further during May, the Dow Jones Global Technology Index continued to outperform the broader market, gaining 8.6pc in sterling terms. The internet sub-sector was particularly strong (NASDAQ Internet Index returning 13.1pc during the month) on the back of continued strength in e-commerce data points despite reopening activity.” Next figures due: 15 July

Sea Limited/ SE Buy @ $104 The leading internet company in SE Asia based on number one market share by revenue in theregion’s online game market, number one market share by GMV [gross merchandise volume] and total orders in e-commerce market, and position as a leading player in digital financial services market, each in 2019. – “The coronavirus crisis is driving a step change in the growth of the digital economy globally, particularly in the market and the segments where Sea operates. Building on our market leadership in some of the key and the largest segment of the digital economy, we believe we are gaining and will continue to gain a disproportionate share of that growth.” Next figures due: 25 August

ServiceNow/ NOW Buy @ $401 6,200+ global enterprise customers include nearly 80pc of the Fortune 500. They all rely on ServiceNow solutions using the Now Platform—the intelligent and intuitive cloud platform—for successful digital transformation. – “Digital transformation was a business imperative pre-COVID with $7.4 trillion of projected spend over the next three years. Post COVID, digital transformation will accelerate, and ServiceNow is the workflow standard for digital transformation. And most important, the Now Platform, the platform of platforms, has become the standard for workflow design experiences.’ Next figures due: 22 July

Shopify/ SHOP Buy @ $916 Making it easier to start, run, and grow a business, reducing the barriers to business ownership to make commerce better for everyone. – “We’ve seen a notable increase in online store creation, some of which are established retailers.” Next figures due: 30 July

Splunk/ SPLK Buy @ $193 Empowers companies to bring data to every question, decision and action, delivering meaningful outcomes across the entire organisation. – “At this time of remote work, we’ve seen increased demand for Splunk Cloud, driving our cloud mix north of 40pc, the highest ever in our history and well above our expectations going into the quarter. Data matters more than ever in this digital world, and every organisation is on a journey to bring data to everything.” Next figures due: 20 August

Tencent/ 700 buy @ HK$400 Weixin and QQ connect users with each other, with digital content and daily life services in just a few clicks. Advertising platform helps brands and marketers reach hundreds of millions of consumers in China. Financial technology and business services support business growth and assist with digital upgrades. – “For the first quarter of 2020 total revenue grew 26pc year-on-year. VAS [value added services] represented 58pc of total revenue within which online games was 35pc and social networks was 23pc. FinTech and business services represented 25pc of total revenue and online advertising represented 16pc of total revenue.” Next figures due: 12 August

The Trade Desk/ TTD Buy @ $409.50 Through its self-service, cloud-based platform, ad buyers can create, manage, and optimise more expressive data-driven digital advertising campaigns across ad formats, including display, video, audio, native and social, on a multitude of devices, including computers, mobile devices, and connected TV. – “There is a shift in media that started about nine weeks ago that is accelerating the move to data-driven advertising. Nowhere is this more apparent than in Connected TV. It will represent a major land-grab opportunity, and our ability to be successful in that environment rests solely in our own hands. We believe that data-driven advertising is on the front lines of recovery, where advertising fuels and even ignites growth, and where growth fuels more advertising. As The Trade Desk is one of the leaders in data-driven advertising, we strongly believe that we will play a critical role in the global economic recovery.” Next figures due: 6 August

Twilio/ TWLO Buy @ $216.5 Twilio has democratised communications channels like voice, text, chat, video, and email by virtualising the world’s communications infrastructure through APIs that are simple enough for any developer to use, yet robust enough to power the world’s most demanding applications. – “Our platform provides three things the world needs, digital engagement, software agility and cloud scale. Technologies such as messaging, email, voice and video have enabled many parts of the economy to continue working. Twilio has enabled organisations to reimagine many of their communications workloads in days and weeks, not months and years.” Next figures due: 10 August

Veeva Systems/ VEEV Buy @ $236.50 Enables pharmaceutical and other life sciences companies to realise the benefits of modern cloud-based architectures and mobile applications for their most critical business functions, without compromising industry-specific functionality or regulatory compliance. –“Q1 revenue was $337m, up 38pc year-over-year. This crisis has caused significant disruption, but it has also promoted innovation throughout the industry which over time will be beneficial for life sciences and for Veeva. I am more confident than ever in our long-term opportunity and our ability to achieve our $3bn revenue target in 2025.” Next figures due: 27 August

Wix.com/ WIX Buy @ $253 An Israeli software company, providing cloud-based web development services. The Wix website builder is built on a freemium business model, earning its revenues through premium upgrades. – “For the last couple of months the numbers are great, growth has been incredible. We’ve seen many cases of people moving traditional business that has been done in same ways for hundreds of years into a new format, which is completely online. And I think that this change in perception, change in behaviour is something that is probably going to last, and in many ways, just accelerated what would have happen naturally over the next decade or two.” Next figures due: 22 July

Xero/ XRO Buy @ A$88.90 Australian-listed Xero offers a cloud-based accounting software platform for small and medium-sized businesses. with offices in New Zealand Australia, the United Kingdom, the United States, Canada, Singapore, Hong Kong and South Africa. – “With COVID-19 falling late in the year, its impact on Xero’s operating and financial performance for fiscal year ’20 was modest. Operating revenue increased by 30pc in FY ’20 to NZD718.2mn, 467,000 subscribers joined Xero over the past year taking subscriber numbers to just under 2.3m. We monitor global cloud adoption rates closely and estimate that cloud accounting penetration remains at less than 20pc globally, whilst Australia and New Zealand cloud penetration is well over 50pc. ItStill early in our journey and many small businesses around the world thave yet to make use of cloud accounting.” Next figures due: 12 November

Zoom Video Communications/ ZM Buy @ $259.50 Cloud-native platform delivers reliable, high-quality video that is easy to use, manage and deploy, provides an attractive return on investment, is scalable and easily integrates with physical spaces and applications. – “Customers with more than 10 employees grew 354pc year-over-year as we deployed millions of licenses for new customers in the quarter. One new banking customer deployed approximately 175,000 new Zoom enterprise licenses. Usage by customers in the global 2000 grew over 200pc sequentially. We peaked at over 300m daily meeting participants, free and paid, joining Zoom meetings in April 2020, up from 10m in December 2019. Currently we continue to see elevated levels of participants even as governments around the globe have begun to ease stay in place restrictions.” Next figures due: 4 September

Zscaler/ ZS Buy @ $111 Zscaler operates a massive, global cloud security platform that protects thousands of enterprises and government agencies from cyberattacks and data loss. – “We delivered very strong results for the third quarter and we are increasing our guidance for fiscal 2020. We’ve built the right cloud-native security platform for the cloud world and the digital transformation market driving our business as further accelerate combined with our improved sales execution, we are capitalising on the market opportunities to take Zscaler beyond $1bn in annual revenue.” Next figures due: 2 September

There are three questions to which investors want answers. What to buy, when to buy and when to sell. Many people claim to have all the answers but they don’t. Often what they do is they keeping on telling you to sell and then as the years pass and the shares go higher and higher – think Apple, Amazon, Alphabet, Netflix and many others, they edit those sell signals from their memories. It is very hard to hold great shares for year after year. People who do it like Warren Buffett and Jeff Bezos become very rich but they are rare.

I don’t tell you when to sell except when shares go ex-growth and are clearly no longer 3G and that is usually obvious. If a company has problems and its shares are falling it is time to move on but don’t mistake every little hiccup for problems. Amazon may not make big profits with its next set of figures because of the virus and the need to protect warehouse workers but it is still a great 3G business as it has been for over 20 years.

I focus nearly all my attention on the first of the three questions – what to buy. If I get that mostly right investment success will follow. I only look for growth shares and because my whole focus is on the quality of the business I don’t care much about value or timing, which to me are just distractions. Warren Buffett said something similar. Buy shares in great businesses; hold for the long term and you will do well.

Many people make investing far to complicated by trying to buy low, sell high and perform miracles with timing. The only thing I like to do from a timing point of view is buy shares in all good companies at moments when for some external reason like a virus shares generally are depressed or when something reminds me of what a great business they are.

A great share portfolio is like a great stamp collection – a thing of beauty to be nurtured.

I like the shares mentioned above because they are great 3G + Magic businesses. I think now is a good time to buy but if it is not that won’t change my view of the shares. I will still expect them to come good in the end. If they don’t it will be because they have lost their way as businesses and then they should be sold. If they just look too expensive that is not a reason for selling. Shares in good businesses nearly always look too expensive. Worry about that and you will never buy them in the first place.

Quentinvest is all about building a portfolio of great 3G+M shares. It is not rocket science but you need to do it as though you mean it and then believe in the companies in which you have bought shares unless you are given clear reason not to believe any more.